The lithium battery market is surging, and the undercurrents are surging.

Recently, "New Energy Storage Capital" has heard that many big brothers from power battery manufacturers have come out to start their businesses to do lithium batteries for energy storage. People's first reaction is usually, why do they choose this direction? Is there any entrepreneurial opportunity in this direction?

First of all, let's look at the current situation of lithium batteries for energy storage. According to the statistics of the Energy Storage Application Branch of the Chinese Society of Chemical and Physical Power Sources, in 2021, the installed scale of electrochemical energy storage in China will be 5117.1MW/10498.7MWh, of which 4658.9MW/8254.2MWh will be installed with lithium-ion battery energy storage technology, accounting for 91.0% of the power scale

So, these 8254.2MWh installed in 2021 are all lithium batteries for energy storage? At present, there is no authoritative and reliable statement on this issue. However, according to the research and interviews conducted by "New Energy Storage Capital", there are still relatively few domestic lithium battery manufacturers for energy storage.

According to incomplete statistics, among the big power battery manufacturers, there may be only CATL and EVE lithium Energy and other large manufacturers outside the power cell production line, there is a special R & D team and production line for energy storage cells; outside the power battery, there are also companies that specialize in lithium batteries for energy storage, such as Pai Energy Technology, which specializes in overseas household energy storage cells, non-household energy storage special lithium batteries, Haichen New Energy and Haiji New Energy, Tianhui Lithium, Kunyu New Energy, etc.

Nevertheless, many of the cores used in the domestic energy storage market are still not dedicated to energy storage but are still power cores or their transformation models. That is to say, in the cognitive and practical operation, the power battery and energy storage battery in the market does not make a particularly clear distinction. So can power cells be used directly in energy storage scenarios?

What are the essential differences between power and energy storage lithium batteries?

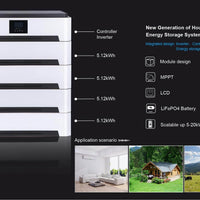

From the application scenario, power lithium batteries are mainly used in electric vehicles, electric bicycles and tricycles, and other electric tools, while energy storage lithium batteries are mainly used in peak and frequency regulation power auxiliary services, renewable energy grid-connected consumption, and industrial and commercial energy storage, micro-grids and other fields.

The application scenarios are different, and the performance requirements for batteries are also different. If we use a sentence to summarize the requirements of lithium batteries for energy storage, it is high safety, long life, and low cost.

First, due to the frequent occurrence of safety accidents in energy storage power plants, lithium batteries for energy storage do not require high energy density but high safety requirements.

Power lithium battery as a mobile power, under the premise of safety for the volume (and mass) energy density as high as possible to achieve a more durable range. At the same time, users also hope that electric vehicles can be safely fast charging, so the power lithium battery for energy density and power density have high requirements, just because for safety reasons, the current general use of about 1C charge and discharge capacity of energy-based batteries.

The vast majority of energy storage devices do not need to move, so the energy storage lithium battery does not have direct requirements for energy density. As for power density, different energy storage scenarios have different requirements.

For power peaking, off-grid PV energy storage or user-side peak-valley spread energy storage scenarios, energy storage batteries are generally required to be continuously charged or continuously discharged for more than two hours, so capacity batteries with charge/discharge multiplier ≤0.5C are suitable; for power frequency regulation or energy storage scenarios to smooth out renewable energy fluctuations, energy storage batteries are required to be rapidly charged and discharged in seconds to minutes, so ≥2C power type batteries are suitable. In some application scenarios that require both frequency regulation and peak regulation, energy-type batteries are more suitable, but of course, power-type and capacity-type batteries can be used together in such scenarios.

Since energy storage cells have higher safety requirements, it requires battery companies to make certain innovations in materials and structures to meet the market demand.

Second, lithium batteries for energy storage have higher requirements for calendar life and cycle life.

The life of new energy vehicles is generally 5-8 years, while the life of energy storage projects is generally expected to be greater than 10 years. The cycle life of a powerful lithium battery is 1000-300 times, while the cycle life of an energy storage lithium battery is generally required to be at least greater than 3500 times, and it is hoped that through the development of new operation and maintenance regeneration technology, to achieve a long calendar storage life. So we see Ningde Times are developing the cycle life of 10,000 times of the battery cell.

Third, lithium batteries for energy storage are more sensitive to cost.

Facing competition with traditional fuel power sources, lithium batteries for energy storage need to face the cost competition of traditional peaking and frequency regulation technology. The scale of energy storage power plants is basically above the megawatt level or even a hundred-megawatt level, so the cost of lithium batteries for energy storage requires lower cost than that of lithium batteries for power.

It can be seen that the power lithium batteries and energy storage lithium batteries have significant differences in performance requirements, the big guys' part of the departure in addition to the A to start a business is precise because they see the business opportunities.

Although this difference is not the year from 3C battery to power battery innovation in the battery material system, in the energy storage battery market under the stimulation of the huge imagination space, in the same material system based on the "higher safety", "longer life", "lower cost" which performance innovation is still huge. The commercial imagination brought by the performance innovation of "higher safety", "longer life" and "lower cost" is still huge.

According to third-party statistics, the global demand for energy storage batteries is expected to reach 218GWh in 2025, with a compound growth rate of about 38% and an average annual new demand of >130GWh.

It can be seen that the market prospect of lithium batteries for energy storage is broad. In the lithium battery market dedicated to energy storage, the global and domestic market has not yet formed a specialized leader, which is a good market opportunity window for emerging startups.

But what should not be ignored is that this time window will not be long. Therefore, we predict that in the coming period, there will be more power battery bigwigs coming out one after another to start their businesses, specializing in lithium batteries for energy storage.

0 comments